Millions of pounds are spent every year on interventions that aim to help people in the UK better manage their money. Even so, relatively little was known about ‘what works’ to improve financial capability – until now.

In April 2016, the Money Advice Service (MAS) – now part of the Money and Pensions Service – created the What Works Fund (WWF) to fill major gaps in the UK evidence base for financial capability. The fund is underpinned by our firm belief that good decision making must be grounded in good quality evidence. Where evidence is not available, we should use high quality methods to find out what works and – just as crucially – what doesn’t.

How evaluation supports The Financial Capability Strategy

The gaps in knowledge that the WWF tried to address were organised around 16 What Works policy questions focused on six of the UK Financial Capability Strategy’s target audiences:

- children and young people

- young adults

- working age adults

- retirement planning

- people in retirement, and

- people in financial difficulties

How grantees used the funding

Following a rigorous proposal development and selection process, we awarded what works funding to 65 projects across the UK. Our grantees targeted all demographics using a wide range of delivery approaches including: intense one-to-one support, school workshops, peer-led group sessions and mobile app-based support. Two thirds of the projects used the funding to pilot and learn from new approaches, while others evaluated existing work, including scaling up current activity.

Effective evaluation: tools and partners

An important goal that we wanted to achieve through the WWF was to produce new evidence in a robust and consistent way, using a common set of comparable outcomes. As such, grantees were expected to use the Strategy’s Evaluation Toolkit and its financial capability outcomes frameworks as a condition of grant funding.

To help our grantees carry out high-quality evaluation, we also engaged an evaluation and learning partner (ELP) formed of three research and evaluation specialists: Ipsos MORI Public Affairs, the University of Bristol’s Personal Finance Research Centre, and Ecorys. The ELP supported and quality-assured the work of our grantees from the initial design stage of their evaluation through to implementation and reporting.

Results are in

After more than two years of intensive work, we are extremely proud to see the results coming in. To date, 55 grantees have concluded their evaluations, and the remaining ones are due to submit soon.

Across the WWF portfolio, we’ve funded 65 projects, invested over £11 million, reached over 40,000 people, and tripled the amount of UK-based evidence available on how to improve people’s financial capability. For the first time, we’ve gathered substantial, robust evidence on what works, what doesn’t, why, for whom, and in what circumstances, filling gaps in knowledge by answering some key strategic questions.

Key learnings include:

- Training teachers to deliver financial education is doubly effective. Such training has a clear positive impact for students, improving outcomes across their mindset, ability, and connection (access to financial products, advice and guidance). Teachers also feel more confident in delivering financial education and evaluating its effectiveness.

- Life events offer ‘teachable moments’ to support financial capability. The WWF has reinforced the importance of ‘teachable moments’ – times when people are receptive to new knowledge, attitudes or skills – and what these mean for financial capability interventions. Building financial capability support into broader responses delivered at these times is effective, and the WWF projects shed light on different types of engagement models.

- Technology is not a simple answer to scaling up financial capability interventions. The WWF grantees had varied success when testing the effectiveness of different digital interventions to improve financial capability. While there were some positive outcomes around mindset and ability for participants who tested money apps and online learning tools, the WWF projects found that people need help to overcome particular barriers to digital engagement. Providing personalised, one-to-one support alongside a digital tool is shown to be an effective way to help people to engage with, value, and keep using the tool.

Our WWF evaluations include some large-scale studies and randomised control trials that have tested ‘what works’ in a consistent and comparable way thanks to our outcomes frameworks. This is the first time that comparable data has been produced at this scale in the UK, meaning that decision makers can now directly compare different approaches and their effectiveness.

Of course, we want all this evidence to be openly available, so that together we can put it into action and help more people make the most of their money. With this in mind, we’ve made all the WWF evaluation reports available on our free-to-use Financial Capability Evidence Hub, a comprehensive collection of financial capability evidence and insight from the UK and elsewhere.

We also wanted to make sure that decision-makers could understand the bigger picture, so our ELP has produced a thorough analysis of all the WWF evidence, summarising everything we’ve learned about ‘what works’ to improve people’s financial capability in one place.

This ‘Evidence Analysis’ is part of a suite of outputs that will be produced by our ELP to make the WWF evidence useful, accessible and relevant to a wide range of audiences, from researchers and evaluators, to policy makers, practitioners and commissioners of financial capability interventions.

What's next?

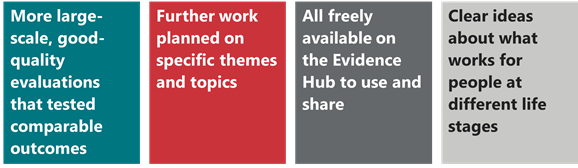

Thanks to the What Works Fund, we now have better insights into what works and what doesn’t, so every penny decision makers invest in financial capability programmes is better spent. Future financial capability interventions will be far more effective and far more efficient as a consequence.

The evidence collected will inform ongoing activity as part of the UK Financial Capability Strategy as well as at the Money and Pensions Service, a new organisation which began operating on 1 January 2019 and brings together the Money Advice Service, The Pensions Advisory Service and Pension Wise.

Want to know more about improving financial capability?

If you want to know more about how to improve financial capability for children and young people, or what are the design and implementation tips and challenges for financial capability interventions targeted at working age adults or older people, please do take look at our analysis here: https://www.fincap.org.uk/en/articles/learning-what-works-fund

Leave a comment